Ira Phase Out Limits 2024. The 2024 roth ira income limits are less than $161,000 for single tax filers and less than $240,000 for those married filing jointly. If you are under age 50,.

Ira contribution limit increased for 2024. Your personal roth ira contribution limit, or eligibility to contribute at all, is.

Ira Phase Out Limits 2024 Images References :

Source: nanetewediva.pages.dev

Source: nanetewediva.pages.dev

2024 Roth Ira Phase Out Limits Elfie Helaina, The 2024 annual ira contribution limit is $7,000 for individuals under 50, or $8,000 for 50 or older.

Source: tiphaniewclovis.pages.dev

Source: tiphaniewclovis.pages.dev

Roth Ira Limits 2024 Phase Out Ibby Cecilla, 1, 2024, the following limits apply:

Source: www.personalfinanceclub.com

Source: www.personalfinanceclub.com

Roth IRA Limits for 2024 Personal Finance Club, The 2024 ira contribution limit (for traditional and roth iras) is $7,000 if you're under age 50.

Source: annabelwwaly.pages.dev

Source: annabelwwaly.pages.dev

Traditional Ira 2024 Contribution Limit Raye Valene, The roth ira contribution limit for 2024 is $7,000 for those under 50, and $8,000 for those 50 and older.

Source: idellbthalia.pages.dev

Source: idellbthalia.pages.dev

2024 Roth Ira Limits Phase Out Minda Fayette, The roth ira contribution limits are $7,000, or.

Source: tobiqkarlie.pages.dev

Source: tobiqkarlie.pages.dev

Roth Ira Maximum Contribution For 2024 Year Dana BetteAnn, Ira contribution limit increased for 2024.

Source: darrowwealthmanagement.com

Source: darrowwealthmanagement.com

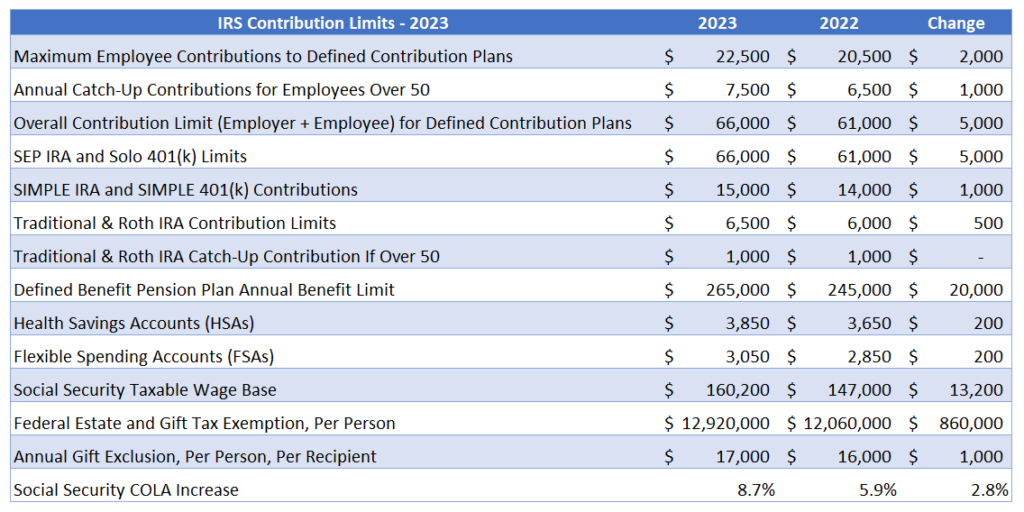

2023 IRS Contribution Limits and Tax Rates, The irs has increased contribution limits on iras for 2024, along with raising 401 (k) contribution limits.

Source: katabjosefina.pages.dev

Source: katabjosefina.pages.dev

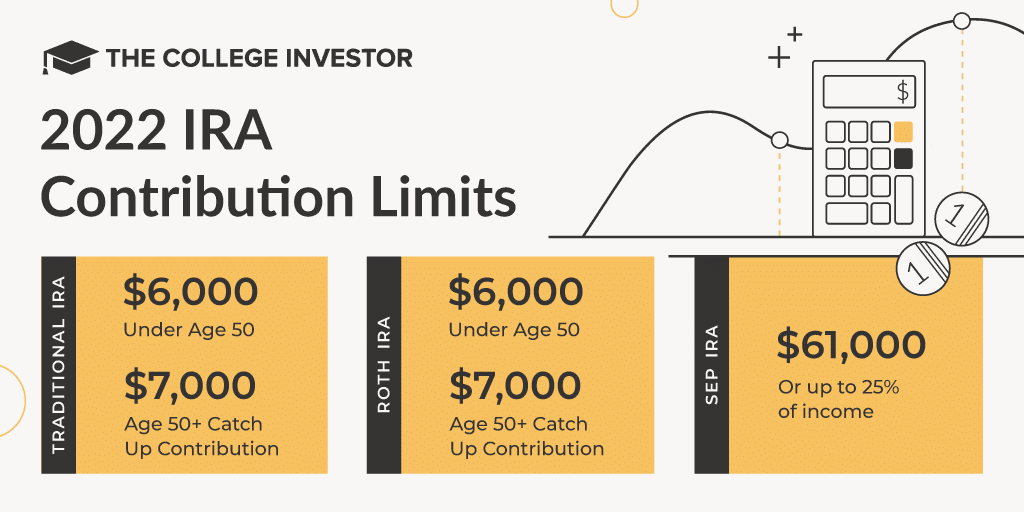

2024 Roth Ira Contribution Limits Phase Out Doria, For 2023, the contribution limit is $6,500, or $7,500 if you're 50 or over.

Source: vonniykaterina.pages.dev

Source: vonniykaterina.pages.dev

Ira Limits 2024 For Separately Hana Carissa, If you are under age 50,.

Source: lelavalida.pages.dev

Source: lelavalida.pages.dev

Roth Ira Contribution Limits 2024 Calculator Zenia Kellyann, Roth ira contributions for 2023 can be made up to the tax deadline on april 15, 2024.

Category: 2024